Accept international credit cards, price in multiple currencies. Target new markets and close more sales.

Multi-Currency Processing is available for retail, restaurant, hospitality and e-commerce merchants.

Merchants can accept credit cards from international and domestic cardholders, with the ease of only one merchant account. They can price in multiple currencies, target new markets and close more sales, helping turn international browsers into buyers.

Multi-currency with eCommerce

Merchants are able to increase their global revenue by accepting and processing payments from customers all around the world on their eCommerce stores.

Target new markets by pricing in multiple currencies while getting paid in your own! We provide payment gateways for US and Canadian merchants that are PCI compliant multi-currency payment solutions and complete end-to-end online credit card processing for web, iOS and Android mobile devices.

Benefits for shoppers

- No surprises

Customers see the exact amount of their purchase in their home currency at time-of-sale and on their statement. - Certainty

Leisure travellers enjoy the certainty of knowing the final cost in the currency they understand best – their own. - Convenience

Business travellers appreciate the convenience of accurate expense accounting.

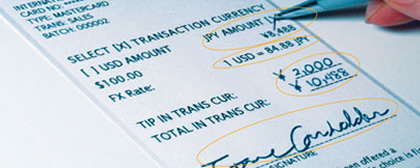

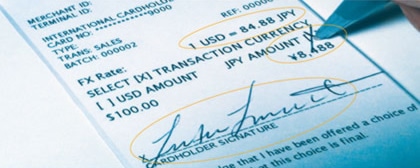

How multi-currency works in a card-present environment

- Eligible MasterCard® or Visa® transactions are automatically identified at the point-of-sale after the card is swiped or keyed.

- The terminal prints the receipt displaying the transaction total in the local currency, the foreign exchange rate AND the customer’s home currency.

- The customer selects their currency on the receipt and signs the receipt

- The final amount on the customer’s receipt will match the amount on their credit card billing statement.

Benefits of Accepting Multi-Currency

- Attract new, international customers

- Encourage repeat business

- Create personalized pricing experience

- Offer superior customer service

- Satisfied customers see the exact amount of their purchase in their home currency

- Reduces chargebacks caused by customers not recognizing transactions

International Processing

Cross border processing solutions – offshore accounts

Given the globalization of the world economy, many merchants have widened their customer reach by selling products beyond their national borders: we encourage merchants to consider the benefits of allowing customers to pay in their native currencies, since it is proven that consumers prefer to shop and purchase in the currency they know the best: their own!

With their local presence in countries around the world, our partners deliver global, end-to-end payment processing solutions.

We help merchants improve operational efficiencies and control their overall cost of payment processing by not having to maintain multiple vendor relationships with different processes and reporting systems.

Whether your company is located in the USA, in Europe or anywhere in the world, we can find customized solutions for your needs.

Currencies accepted / Bank account requirements

- Over 150 currencies accepted

- Settlement available in over 15 different currencies

- Bank account can be located anywhere in the world

Types of Cards accepted

- Visa, Mastercard, American Express

- Local Payment methods in some countries

Types of Businesses accepted

- Any legal business operating over the phone, mail, or Internet)

- “High Risk” profiles can be approved on a case by case basis

- Card Present merchants located outside of the USA can be approved on a case by case basis

- Merchants without US Social Security numbers